Southern Lakes houses now average $500,000 more than Auckland

The latest housing market report from QV shows the Queenstown Lakes is the only region in New Zealand to escape significant property value falls in the last three months.

The average Southern Lakes home value has increased by 0.8 percent this quarter to $1,732,135 – a change from the 1.3 percent quarterly decline reported in last month’s QV House Price Index.

That local market value figure is now 2.4 percent higher than the same time last year, compared to a 8.2 percent average annual home value loss nationally.

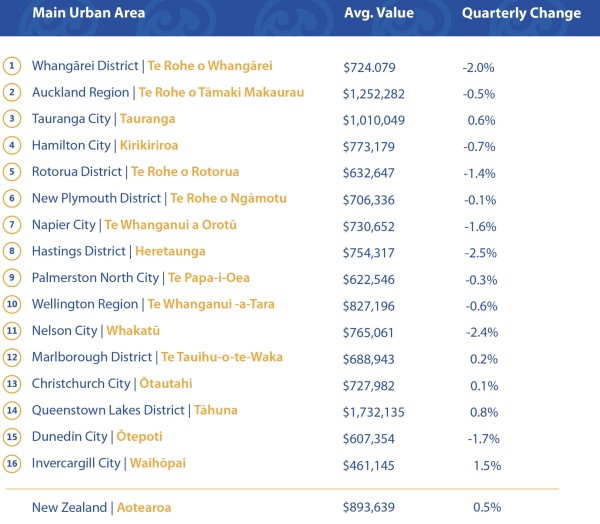

Dramatic regional differences have emerged in QV's latest data.

The current Auckland average house price is $1,252,282, more than half a million dollars less than the Southern Lakes, and down 9.5 percent in the past 12 months. Wellington’s average house price sits at $827,196, Christchurch's at $727,982, Dunedin's at $607,354 and Invercargill's at $461,145.

In spite of dramatic falls QV’s operations manager James Wilson has offered a reasonably upbeat forecast for the property market generally.

“If we step back and take a good look at the housing market at a high level, things are beginning to look a little healthier now. For the first time in a while we are seeing value increases in some areas of Aotearoa – especially in places where there is strong demand for entry level housing.

Generally speaking, it’s a case of the more affordable end propping up the market overall, with areas coming off low value bases continuing to be among the strongest performers. The obvious exceptions among the main urban areas we monitor are Tauranga and Queenstown, but in both of these places values at the lower end of the market are growing while values at the upper end are still soft.”

Though sales volumes have increased from month to month, new listing numbers continue to soften overall.

QV’s operations manager James Wilson

“Real estate agencies are beginning to report growing interest for a reduced number of new properties coming onto the market, with buyers having to compete for the best ones. This is pushing up values once again,” Mr Wilson says.

“It seems market confidence is increasing, but the upcoming election has also encouraged many buyers and sellers to adopt more of a ‘wait and see’ mindset. It’s also important to remember that strong economic headwinds are still blowing, with many households still re-fixing their mortgages at significantly higher interest rates. It’s likely this will continue to restrict investors in particular.”

Now, as all eyes look toward next month’s general election, Mr Wilson said the housing market would continue to vary considerably from region to region.

“While values begin to strengthen in some areas, the rate of growth is not expected to bounce back at a significant rate. More likely, we’ll continue to witness flat or gently rising value levels in many areas, while other areas continue to bottom out.

“We’ll have a clearer view of what’s next for the housing market after 14 October. By that time, we’ll also have some indication of whether or not we’ll see the usual spring surge in listings that we typically experience around this time of year."