Lakeview land ready, but ratepayers could wait 20 months for developer payment

It may be more than a year before the developer of the Lakeview site hands over any money to the Queenstown Lakes District Council.

While council completed works to allow for the handover of the central Queenstown land several weeks ago it doesn't follow that the land will change hands immediately.

The development agreement between the two parties has a 20 month sunset date that kicks off from when the council completes its side of the bargain.

Officially, that happened on August 21, when the developer was given notice works had been completed.

The issue of payment to ratepayers was a topic of discussion at a workshop at the council's Gorge Road chambers today, where Ninety Four Feet managing director Dean Rzechta provided the mayor and councillors with an update on project progress.

The development will take shape on 10 hectares of impressive real estate below the gondola in Queenstown - the former home of the Lakeview camping ground.

The council is selling the land in stages to Ninety Four Feet, in a deal locked in five years ago and involving some profit sharing.

But, back to that first payment.

The council has achieved 224c subdivision certification and titles have been issued by Land Information New Zealand, but at least one councillor, deputy mayor Quentin Smith, asked for clarification around why the land purchase was not following more promptly.

QLDC staffer Paul Speedy, who is managing the project on behalf of the council, told the workshop "just because we got title, there isn't an instantaneous settlement".

"The hard date is 20 months after council completion."

The deal stipulates construction work needs to be ready to go before Ninety Four Feet settles on the land.

Mr Rzechta said that requires construction funding to be in place, and to secure that requires documentation including building consents and fixed price contracts.

"That's months of work ahead of us."

He said, from a council perspective, "risk is effectively completely mitigated at that stage" and he questioned those in the room about how "comfortable" they would be selling the land with no "certainty on the job potentially happening".

"The DA was negotiated to make sure you have everything in place before you hand over the title."

His ballpark optimistic timeframe for construction to begin, "early to mid next year", he told today's workshop.

Councillor Smith said "this has been coming for a long time" and he was surprised things did not "align a bit more closely".

Mr Rzechta said sales of units are tracking well at the lower and upper price points, and the company may consider making some internal design changes to its tower blocks to introduce "a cheaper product in the 600s" - most likely a 25 to 30 square metre studio.

Entry level studio and one-bedroom units are being advertised at $750,000.

Mr Rzechta said "the middle" has proved to be the biggest selling challenge.

He reassured councillors who queried it that the company was "comfortable" any design changes being considered would fit within the development agreement and the fast-tack consent approval.

At the completion of his workshop presentation Mr Rzechta provided slideshow images of a just completed project in Auckland - the $250 million, 41 level Hotel Indigo and apartments.

He said he sized up the Auckland site eight years ago - the same trip to New Zealand where he visited Queenstown and meet with QLDC staffer Paul Speedy to see the Lakeview site for the first time.

"We're really proud of what we've achieved."

Lakeview on the agenda again

The Lakeview development has also been flagged as an agenda item for a meeting of the council's Audit, Finance and Risk Committee on Thursday.

Members are being asked to note a report by Mr Speedy outlining key milestones on the project, some of which were canvased during today's workshop.

The report also updates on costs to the council to ready the Lakeview site for handover, as well as potential money to be made.

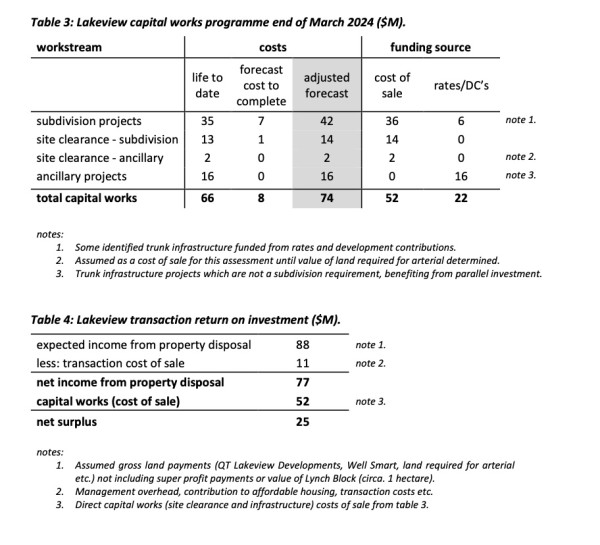

According to the report, as at the end of March, the council had spent $66 million on capital works related to the site, and was forecast to spend $8 million more, a total $74 million.

Some $22 million of that is funded by rates or development contributions, while the remainder - $52 million - will come from the sale, it says.

Expected income of $88 million is expected from the Lakeview transaction, $11 million of which will be lost in transaction costs, leaving a net income of $77 million for the council, and a net surplus of $25 million once the $52 million of capital works is taken into account, it says.

Following still? These tables are included in the report. Otherwise, find the full report with the committee meeting agenda here.

A screenshot of the 'Lakeview Update' report provided by Paul Speedy ahead of an Audit, Finance and Risk Committee meeting to be held Thursday, September 12.