Council debt: QLDC edges $186 million closer to debt limit

Analysis

Draft Queenstown Lakes District Council accounts show that debt in the current financial year to June 2023 has blown out by $23 million.

Combined with the $163 million that council budgeted from a visitor levy that now is unlikely to happen, that leaves a $186 million fiscal hole that will be hard to manage, especially if the QLDC is to stay below the 2024 debt limit of a 290 percent revenue to debt ratio.

The council is also facing an increasing issue with residents being unable to afford recent rate rises, with $5.35 million in unpaid rates in the latest (unaudited) accounts. Some 2,936 properties were behind in their rates at June 30. The recent 14 percent rates rise is likely to make this problem even worse.

At the same year end date total council debt stood at $525.4 million. This is $23 million more than the forecast debt level of $502 million.

The QLDC has explained to Crux that the current debt ceiling is 295 percent as set by the Local Government Funding Agency. But that ratio decreases by five percent each year until it reaches 280 percent in the 2026 financial year. In 2024 the debt ceiling is 290 percent, producing a scenario where, as the debt ceiling gets lower annually, council expenditure is not showing a sufficient downward trend.

Council chief executive Mike Theelen has just been awarded an eight percent pay rise to $415,321.09 while council staff numbers in recent years have increased from 383 to 663, with the number of staff paid $100,000 or more climbing from 85 to 124.

The combined effect of this year’s $23 million blowout and the likely disappearance of the visit levy will but great stress on the QLDC’s finances.

In response to questions from Crux a QLDC spokesperson agreed that the recent debt data will be closer to the 2024 290 percent ration celling than was forecast in the 2024 annual plan, adding:

“Council will continue to adjust capital budgets through the regular re-forecast process to ensure that we stay compliant with borrowing limits. This will likely see further deferrals of some capital projects.”

Crux also asked about the status of two large over-budget projects – Lakeview and stage one of Queenstown's Arterial Road.

The Arterial Road budget currently stands at $110 million for just under 700 metres of road construction. This is up from the May 2023 budget figure of $108 million and over double the original budgeted figure. Funding for stages two and three of the project is extremely uncertain meaning the entire project may fall short of the desired traffic outcomes.

As for the Lakeview preparation work, paid for by the ratepayer to date, we asked the QLDC what the penalties were if the council did not hand over the site as required by contract deadlines. There was no clear answer to this point beyond the QLDC saying that an updated report will be presented to the next meeting of the Audit, Finance and Risk Committee on Thursday, October 5.

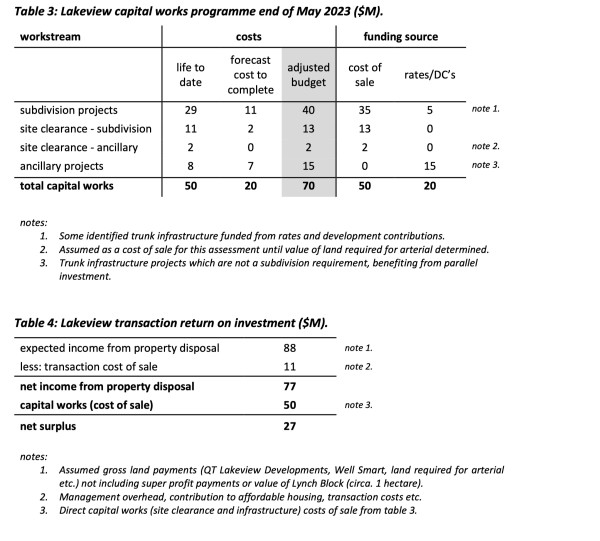

The latest analysis from the QLDC shows that a “surplus” in terms of ratepayer investment depends on what is classified as direct Lakeview work and what is presented as work that benefits adjacent, existing houses.

QLDC's own analysis of Lakeview spend and return on investment depends on the definition of what's direct spend for Lakeview and what's not direct spend.

Crux has reported extensively on the fact that the Lakeview land could have been sold outright for $42 million, but under the sole delegated authority of council Mr Theelen ratepayers were committed to a complex, and not fully disclosed, agreement that depends on future “super profits” with the Australian developers getting up to 20 years to pay for the land. In basic 2023 terms that means that instead of $42 million income, the council has spent $70 million - a loss of $28 million. There are also associated per-budget costs linked to the arterial road that had the Lakeview development as one of its main strategic targets.

Without stages two and three of the arterial road being funded the construction project won't even reach Lakeview.

Part of the current rates rise has been attributed to a cost blowout by the council on their land preparation for the developers.