Boomers, farmers, and Southern Lakes - doing well, despite the recession

As New Zealand staggers through a downturn that could drag into next year, you don't have to look far to find examples of people and businesses feeling the pain.

Household budgets have been put under pressure as the average fixed home loan rate being paid rose from less than 3 percent to 6 percent. Big name retailers like The Warehouse have posted significant losses. Even the government has cut itself down to an operating allowance that is described as barely enough to keep the lights on.

So who's actually doing well right now?

While some of the economic bright spots are just areas that are only doing less badly than the rest, there are a few industries and households standing out.

Power companies

Businesses that produce things people have to buy are holding up better, and power companies have extra reason to celebrate.

Research firm Morningstar said Rio Tinto's decision to stick with the Tiwai Point aluminium smelter until the end of 2044 was a boost for the whole sector.

If it had closed the smelter, it would have led to much lower wholesale electricity prices for the medium term, hurting the earning potential of gentailers.

It said Meridian would benefit the most as the smelter's key supplier, followed by Contact Energy and Mercury Energy, but everyone would win.

"Genesis Energy and Manawa Energy have no direct exposure but the move reduces risk for the whole sector because it will support electricity demand and prices."

Morningstar said it had upgraded Meridian's medium term earnings forecast by 10 percent because of the new contract and strong underlying performance.

Pathfinder portfolio manager Hamesh Sharma said gentailers were not hurt by the weaker economic activity more broadly, because people still had to pay for power, while there was increasing demand because of the transition to electric vehicles.

"Stocks that have had a good couple of months or year-to-date are those that have exposure to the mega themes where demand is still robust and not dependent on the broader economy."

Other providers of essentials - such as banks - have also weathered the storm better than some. Banking net profits after tax held at record levels of a combined more than $7 billion in 2023, according to KPMG.

Dairy farmers

While meat farmers are having a tough time, things are looking up for dairy farmers.

Craigs Investment Partners investment director Mark Lister said dairy prices were at their highest levels in about 18 months.

Fonterra's forecast payouts were solid and indicated the potential for an increase.

"The agricultural sector is in a little bit better shape [as are] some industries tied to the agricultural sector."

Baby Boomers

ANZ chief economist Sharon Zollner pointed to Centrix data, which shows that older households were under less pressure than their younger counterparts.

Its data for hardship - usually reflecting cases where a provider has approved an application for a borrower to have the terms of their credit changed due to hardship - shows this is most common among people aged 35 to 39. From 65 the rate of hardship drops rapidly.

Forty-four percent of hardships related to mortgage payment problems.

"Boomers are doing fine," Zollner said. "They are more likely to have term deposits and be really pleased that term deposit rates are high."

Reserve Bank data shows the average 18-month term deposit rate has risen from about 1 percent at the lowest point of the pandemic to more than 5 percent.

She said while those households would also be affected by wider inflation, anyone with savings would have benefited from higher interest rates. Those with a mortgage-free home would also have avoided the rent inflation of recent years.

"We sometimes forget about savers because they are outnumbered but not everyone loses when interest rates go up."

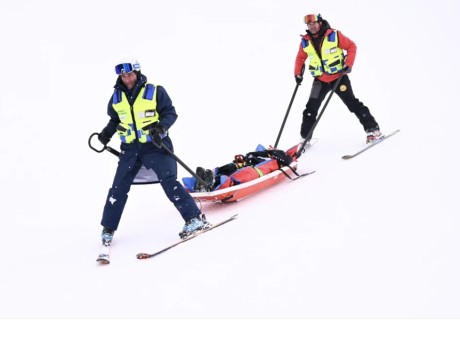

Queenstown

Queenstown and Wānaka have proved very resilient to the downturn hitting other parts of the country.

The Real Estate Institute's house price index shows that nationwide house prices are up 2.8 percent over a year and 5.8 percent over five years. By contrast, Queenstown's prices are up 9.7 percent over a year and 8.7 percent over five years.

"They don't do business cycles down there," Zollner said.

The area is bolstered by international tourism, which has held up better than domestic.

"We're still seeing reasonable tourism inflows," BNZ chief economist Mike Jones said. "We're seeing the South Island in particular record less weak numbers."

Crypto funds

Cryptocurrencies are notoriously volatile but they have been gaining in value recently, taking funds such as Koura's carbon neutral cryptocurrency fund with them. It has posted returns of more than 100 percent over the past year.

From being worth less than $14,000 five years ago, Bitcoin is now worth more than $110,000. Ethereum has lifted from about $400 to $6000.

There is no guarantee this will continue, but for now people with money invested in these currencies are doing well.

Main image (RNZ/123RF): Queenstown and Wānaka have proved very resilient to the downturn.