Q'town house prices average $1.38 million - up 15.6% over a year

From QV:

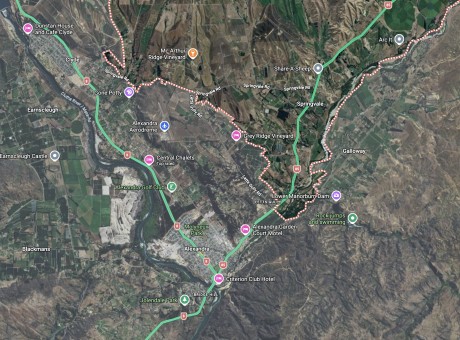

Queenstown/Southern Lakes.

Monthly house price growth has been tapering off in Queenstown since March, when it was 4.1%. It hasn’t surpassed 1% since then, with the latest QV House Price Index recording almost no value growth at all (0.1%) in June.

Annually, it’s a different story, with the average value up 15.6% to $1,386,994. “The removal of loan to value ratio restrictions for 12 months had the intended effect and revitalised investment purchasing with never-seen-before low cost borrowing that has enabled and motivated purchasers,” said local QV property consultant Greg Simpson.

“The market is now in equilibrium and constantly adjusting to Government intervention. It is increasingly likely that the Reserve Bank will also introduce debt to income (DTI) limits to reduce the likelihood of mortgage defaults and to support financial stability and house price sustainability.”

The Rest of NZ.

Quotable Value’s latest figures show a significant reduction in house price growth across both ends of the property ladder – with one main urban centre we monitor even showing a slight decline.

The QV Quartile Index recorded a 2.2% reduction in value growth this quarter across the most expensive houses in New Zealand’s main centres – down from 8.5% growth to 6.3% – while the country’s least expensive houses experienced a slightly smaller 1.4% drop in average value growth (from 8.3% to 6.9%).

The biggest decline in the rate of house price growth, and the only major urban centre to show any sort of quarterly decline in house value since winter last year, was in the upper quartile in Marlborough, which dropped just -0.1% to $1,032,839.

QV general manager David Nagel commented: “Though the drop in Marlborough is almost immaterial, it is statistically significant when you look back at almost 12 months of solid growth across all of the 16 major urban centres we monitor.”

He cautioned there could be similarly small value drops next month across Napier and Queenstown’s upper quartile, where average house price growth has been largely static or slightly down in consecutive months, as well as the first-home buyer’s segment of the Marlborough market, which has also tapered off significantly since March.

“This easing is likely the effect of government intervention and a tightening of credit availability with the return of LVRs and the increasing likelihood of interest rate rises in the near future, not to mention the seasonal downturn that normally accompanies these cooler months,” he said.

“It’s worth reiterating that prices are still generally increasing, but they’re just not going up by nearly as much as they were before. While demand remains high and supply remains low, house prices are generally only going to go in one direction and that’s up. How much higher will likely depend on how much higher interest rates will go.”

“By spring, we should have a clearer picture of what the market is doing and whether or not this cooling effect on prices is here to stay,” he added.

Property prices have risen highest this quarter across the first-home buyer’s segment in Upper Hutt (12.7%), Whangarei (11.6%) and Papakura (10.7%), and across the upper quartile in Franklin (10.9%), central Wellington (10.6%), and Hastings (9.8%).

Rotorua was the only centre to feature in the top 10 twice this month, with the average value of its most-expensive houses increasing by 9.7% since March, and the average value of its least expensive homes rising 8.4% over the same period.

You can now view and keep track of all these value movements via our interactive QV House Price Index.