QLDC rates change leaves ratepayers exposed to extra penalties

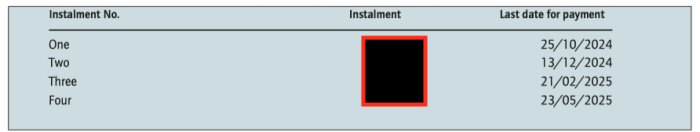

The recent rates demand sent to all Queenstown Lakes District Council ratepayers refers to four equal instalments that are not quarterly. Anyone paying by an automatic quarterly payment (as opposed to a direct debit) will end up with financial penalties as a result of the QLDC changes.

While the rates invoice refers to four payments these payments are unusually not every quarter and are are noted in a Page 3 footnote of an "understanding your rates" document included with the rates demand.

The "quarterly" QLDC rates payments that this year are far from quarterly.

The problem for ratepayers is two fold. Firstly the actual rates bill is late due to the timing of the Long Term Plan process. And secondly, due to the late issue of the rates demand, money is being collected faster using a "short quarter" for the first instalment.

Crux has also been contacted by readers who have tried to set up a QLDC direct debit and found the process to be old fashioned and ineffective.

If you are having unresolved problems with the QLDC rating system and processes please contact Crux - [email protected]

Earlier this year we reported on serious questions around the legality of the way that the QLDC collects rates, including the recovery of $7 million of late payments direct from personal bank accounts.

The amount of overdue rates owed to the Queenstown Lakes District Council has increased to more than $7 million from $5.7 million just a year ago.

The council is asking ratepayers' banks to recover the money from household mortgages or personal bank accounts.

A total of 644 households (totalling $2.1 million in unpaid rates) are more than a year overdue.

The non-payment problem has become so serious that the QLDC has contacted the personal banks of 594 properties looking to get their rates money through a "bank mortgage call".

This process allows the council to "recover as a debt from the first mortgage of a rating unit" under Section 62 of the Local Government (rating) Act of 2002.

A QLDC spokesperson told Crux: "There may also be differences in how each bank extracts payment funds from the customer. For instance, some may take it from the customer’s current account, some may add it to their mortgage."

The rapid increase in rates arrears comes at a time when the QLDC rates have risen dramatically. In the current year the average increase has been 15.8 percent but many properties have seen an actual increase much higher than that average.

The Queenstown Lakes District Council has also discovered that the way it is collecting rates may have been technically illegal for the past 10 years.

Council managers are attempting to correct the problem, but it could expose the council to the risk of legal action, especially over the recent claiming of $7 million of unpaid rates direct from personal bank accounts.

The problem is over who in the council actually has authority to collect rates, and how that authority has been delegated.

A staff report to councillors for Thursday's full council meeting notes:

"External legal advice at that time (2014) directed officers to prepare delegations to specified roles for the Act and for the Resource Management Act 1991 (RMA) which has a similar restriction on subdelegation. Whilst the delegations under the RMA were confirmed by Council resolution in August 2014, a resolution for the Local Government (Rating) Act 2002 cannot be evidenced in official minutes and records. It is therefore necessary to ensure these delegations are conferred by Council resolution to ensure functions, powers and duties under the Act can be undertaken efficiently by officers at the appropriate level."

The same report categories this issue as "high risk."