QLDC likely to lose $163 million of forecast bed tax revenue

The Queenstown Lakes District Council has $163 million of planned future income that depends on the introduction of a local bed tax - a tax that the National Party has dismissed during their current election campaign.

Even the Labour government had the bed tax on a back burner post Covid, but with National leading the polls and 100 percent against a Southern Lakes bed tax it now seems very likely that the QLDC will have to figure out how to fill the $163 million deficit caused by the demise of the levy.

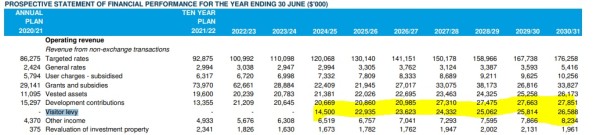

An extract from the council's current Long Term Plan (2021 to 2031) shows just how dependent the budget is on the controversial bed tax from 2024 onwards.

An extract from the current QLDC Long Term Plan - highlighting the bed tax/ visitor levy expectations that are now in doubt - totalling $163 million.

The QLDC is saying via a spokesperson that some of the bed tax money was destined to cover Three Waters costs that may not now be needed but says that "council officers and elected members will need to consider if the levy (bed tax) should proceed depending on the outcome of the general election and how/if the (three waters) reforms progress".

"Either way, a draft of the next Long Term Plan is expected go out for public consultation around March next year. This will outline all the assumptions made in the financial forecasts which in turn will fully reflect the status of our discussions with central government at that time."

Last month QLDC's chief executive Mike Theelen told Crux that:

"The levy (bed tax) requires legislation and was intended to be introduced by way of a local bill which requires sponsorship by an MP. What support there currently is for this, and the priorities of any incoming government, is not something we can predict but we will be taking the matter up with ministers and officials after the general election.”

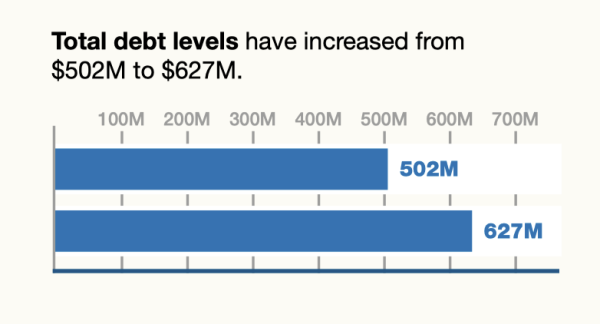

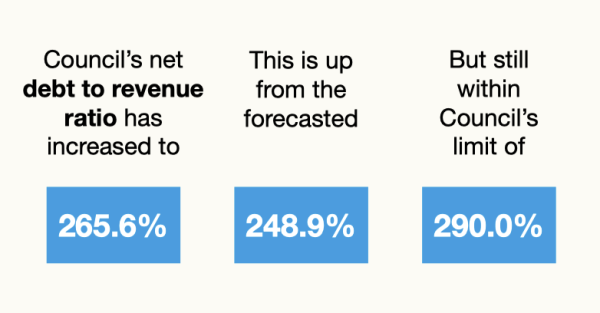

The latest data we have on QLDC debt puts the figure at $627 million - being a 265.6 percent debt to revenue ratio. The debt ceiling is 290 percent, suggesting that the loss of $163 million due to the bed tax not happening has the potential to push the QLDC beyond the debt limit.

Current QLDC debt

The latest debt to revenue ratio from the QLDC - prior to any impact from a bed tax not happening.

Crux has asked the QLDC for an updated financial statement on the council's overall debt position and expects that information to be available for us to publish tomorrow (Wednesday, September 13.) We've also asked for an update on the two major over-budget projects - Lakeview and Stage One of the Arterial Road project.