ORC not 'immune' to inflation - 19 percent rates rise flagged

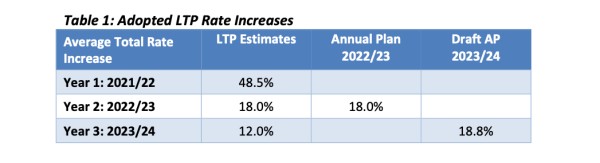

Otago Regional Council ratepayers may be looking down the barrel of a near 19 percent rise in rates later this year, seven percent more than estimated.

If signed off by councillors, households across the region will be paying out an extra $84 on average – a $30 jump from the $54 average increase earlier signalled.

It comes as the council reviews how it will approach its annual plan sign-off for what will be year three of its current ten-year plan at tomorrow’s full council meeting.

Last year, the council opted to “absorb” inflationary pressure keeping rates increases at a projected 18 percent.

ORC chair Gretchen Robertson says it would be 'increasingly difficult and irresponsible' to continue to absorb inflationary pressures (Image supplied).

But this year, it appears something has to give.

Proposed draft expenditure for the year ahead totals $113.5 million – that’s $3.6 million more than planned for in the council’s Long Term Plan, consulted on and agreed to with the community.

Some $1.4 million of it is driven by inflationary impacts on staff costs alone.

It’s proposed the bulk of the deficit be made up for by the bigger than expected rates rise.

The council’s suggesting $3.2 million will need to come from ratepayer pockets to address the shortfall - $3.1 million of it from general rates, and $90,000 from targeted.

Opting to not increase rates for inflation last year has “exacerbated” inflationary impacts this year, a report to councillors for consideration at tomorrow’s meeting says.

Chair Gretchen Robertson says news of any rates increase isn’t something the council conveys “lightly”, but the ORC isn’t “immune” to inflationary pressures.

Costs are rising for councils in the same way they are for any household, she says.

“Last year the ORC absorbed inflationary pressures and, unfortunately, that is no longer an option, given significant rising costs in wages and cost of goods and services at the ORC, similar to many other organisations.”

It would be “increasingly difficult and irresponsible” to continue to do so, she says.

Inflation has been “the wild card” since the initial 12 percent rise was forecast, and it has been building over the past year, she says.

The current level of annual inflation is sitting at 7.2 percent, close to multi-decade highs.

Inflation's hitting everyone, and the Otago Regional Council isn't immune to its pressures, signalling an unexpected 6.8 percent rates increase for the year ahead (Image: Report to councillors, February 2023).

Business as usual

The increase in spend doesn’t equate to any more services or works – it’s what the council needs to pay out to simply provide the services and works already agreed to.

There’s been various workshops to consider swaying from this agreed agenda to cut costs, but the council is opting to maintain its “direction and work programme” as per its publicly-consulted LTP, the report for tomorrow’s meeting says.

ORC councillor Michael Laws is calling the rates hike 'a crime against commonsense' (Image ORC).

But Dunstan councillor Michael Laws says the projected 19 percent rates rise is "a crime against commonsense”, and some cost-cutting is achievable.

First on his chopping block: some staff costs – he’s keen on an independent review of staffing to see where value is, or isn’t, being added.

Second: the ambitious new ORC headquarters for Dunedin – he thinks this project should be deferred as it’s his view it’s not critical spending and there should be a decentralisation of staff, to Dunstan, for example, “where the bulk of the ORC’s work is being done”.

“I’ve made all these suggestions in council workshops - stating them repeatedly”.

However Councillor Robertson says “the council has looked closely at potential organisation savings and efficiencies as part of both normal internal processes and at the request of councillors”, and some adjustments have been made.

“We’ve cut back as much as we felt was acceptable given the commitment we have made to community through wide consultation on this LTP already.”

She makes no apology for the fact the ORC has upped its game to respond to both the needs of the communities it serves and national directives.

“We've been through a lot together as communities over the past three years. It's been a bumpy ride at times.

“However one thing has emerged clearly the need to maintain focus on environment, safety and resilience and public transport is not diminishing.

“(The) ORC is mindful of this. The positive investment ratepayers make to this space is important, valued and never taken for granted.”

But Councillor Laws says he be pushing again for belt tightening.

"I resigned as deputy chair of the ORC last year when governance and senior staff pushed ahead with a similar rates increase. I then accused the organisation of lacking the intellect or insight to appreciate that ORC’s cost-plus mentality was the problem, not the solution.

“My thoughts remain the same on this year’s increase."

His sentiments are echoed by neighbouring Dunstan councillor Gary Kelliher, who says ratepayers have seen "questionable results" from "huge" year-on-year increases to rates bills, with no "real belt tightening".

"Our regions are really hurting and we are facing another recession this year, with a national disaster in the North Island stacked in."

He says he's "reluctantly" supported the 49, 18 and 12 percent jumps, but he thinks it's now time to refocus to delivering "core activities" and "value for money".

"These quantum rates increases have got to stop."

He's constantly hearing from "disgruntled ratepayers struggling to cope with the rising cost of everything", he says.

How much say will the community have?

Tomorrow the council will also decide how they take the changes proposed in the latest annual plan to the public.

Because it’s sticking closely to the programme agreed to through the 2021 to 2023 Long Term Plan, the adjustments don’t trigger the requirement for formal consultation.

Despite this, council staff are still recommending the council talk to its community to communicate the changes and allow them limited feedback.

The latest proposed jump in rate revenue comes off the back of consecutive significant hikes in recent years.

Year one of the current ten-year plan saw a rates rise of 49 percent; while last year it was 18 percent.

Councillors have requested through the LTP a growing dividend from Port Otago - in the coming year, the dividend jumps to $15 million, an additional $5 million on just four years ago - to help smooth rates rises.

Read more: Bill shock despite the ORC's $762 million in assets