Bill shock. ORC's $762 million in assets - 49% rates rise.

Analysis.

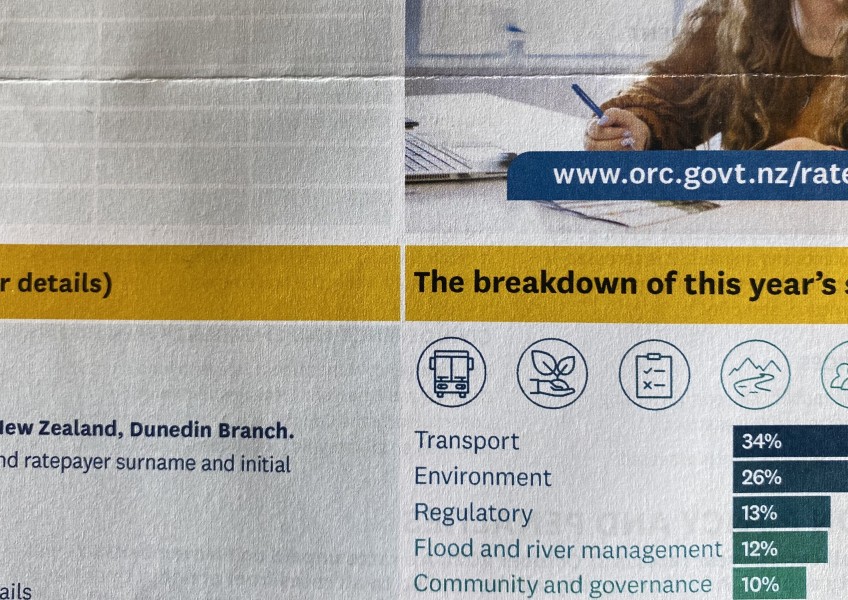

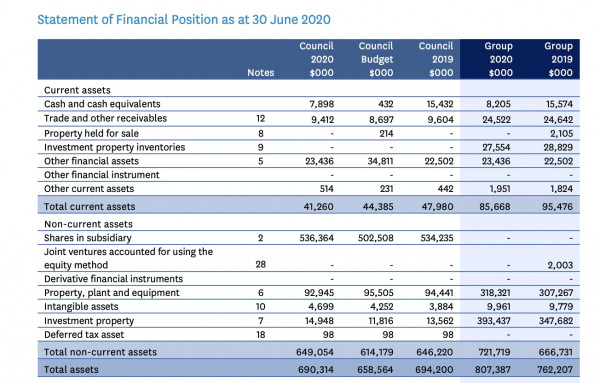

Local residents are contacting Crux and local ORC Councillor Alexa Forbes in a state somewhere between shock and bewilderment after receiving rates demands that are up an average of 49% on last year. It's especially surprising for those who have looked at the ORC Balance Sheet that shows assets of $762 million - a three quarters of a billion dollars. The money is mainly tied up in 100% ownership of the Port of Otago and various property investments.

ORC Deputy Chair Michael Laws during last year's nasty coup that removed Chair Marian Hobbs

Over the past year or so we've seen disappointing dysfunction at the ORC with a nasty coup last year that ousted Chair Marian Hobbs and the recent four and a half hour marathon ORC meeting that fudged a key water quality issue and highlighted the infighting and vested interest politics that seems to dominate governance of the ORC.

So why are we, 300 kilometres away from Dunedin, funding this messy and seemingly ineffective organisation that controls our (lack of) local water quality, (lack of) rabbit control, (lack of) wilding pine control and a very patchy public bus service (Queenstown's QLDC subsidised $2 Orbus service.)?

We asked Alexa Forbes why the rates have gone up so much when the ORC is sitting on three quarters of a billion dollars in assets. Specifically we asked if ORC can’t use that money held in reserve, why doesn’t it return it to the community?

Alexa Forbes. "The issue is that our assets aren’t cash so aren’t available to spend. The biggest asset is the Port of Otago followed by infrastructure assets.

"We do hold investments in the managed fund ($25M) and the income on this and dividends from the Port are used to offset rates and this is a significant subsidy every year ($14M in year 1 of the LTP).

ORC's balance sheet - that's $762 million sitting there in assets

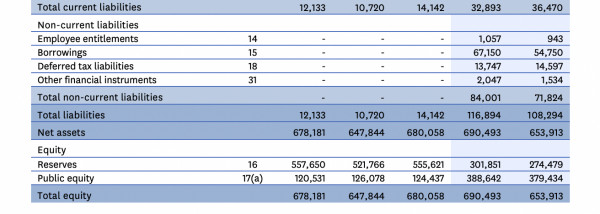

ORC Liabilities are modest in comparison to assets.

But spending the underlying investment, i.e. the capital, on operational spending would quickly use the cash we have and simply move the rates requirement to future ratepayers which doesn’t meet the intergenerational intention of these assets.

ORC CEO Sarah Gardner and Chair Andrew Noone

This is all outlined in the financial strategy included in the LTP so a look at that might help. You’ll find it starting on page 76 of this document. https://www.orc.govt.nz/media/10139/orc-longtermplan-web-144dpi.pdf. It also outlines why we’re planning to take on external debt to help manage this from a cashflow perspective.

ORC Councillor Alexa Forbes

Page 79 of that strategy is clear:

“Council’s strategy is also that it will not use reserves to fund day to day, business as usual type operating costs, as this is not considered a prudent use of reserves. There are, however, special cases where Council’s revenue policy does allow for operating expenditure to be funded from general reserves, for example, research and development costs, or specific one-off activities or projects and activities have benefits that continue over the following years.

“In the 2020-21 Annual Plan Council decided to use general reserves to offset a significant increase in general rates with a view to recovering that amount over the early years in this 10-year plan. With significant additional expenditure now required in the next 10 years, Council has decided to fund the 2020-21 shortfall as a one-off from general reserves. Going forward over the next 10 years Council is not proposing to offset general rates in this way as the uncertainty that further expenditure increases may compound future year rates increases is too great.”

Alexa Forbes. ORC Councillor.