A J Hackett $10 million - company claims "no support from shareholders or banks"

A Crux Investigation.

In their application for $10 million of Government support, Queenstown bungy company A J Hackett declared that they had been unsuccessful in securing financial support from their bank or shareholders – in spite of a strong trading history and their shareholders being some of the wealthiest people in the district.

Tourism Minister Kelvin Davis

Crux has obtained, under the Official Information Act, a complete copy of the A J Hackett funding application form as well as correspondence between Tourism Minister Kelvin Davis and AJ Hackett’s CEO David Mitchell.

The Government application process requires A J Hackett to have exhausted all other possible sources of funding before turning to the taxpayer. The penalty for not being truthful in this declaration is partial or total withdrawal of Government support.

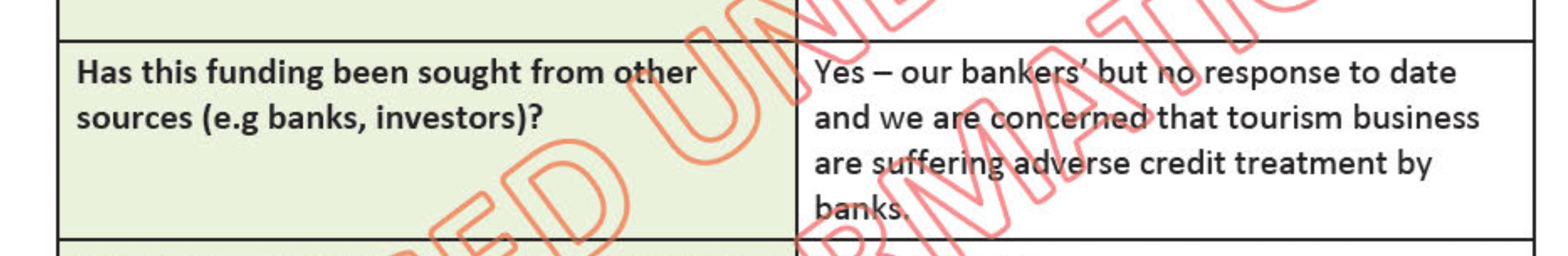

In their official application, A J Hackett is asked by the Government if the funding ($10 million in grants and loans) has been first sought from other sources such as banks and investors.

Their official answer is that their bank has “not responded” to funding requests and they speculate that banks generally might be reluctant to fund tourism companies post Covid. No reference is made to shareholders or investors in spite of the question being asked on the form.

A J Hackett claims their bank did not respond to a funding request - from their Government application form.

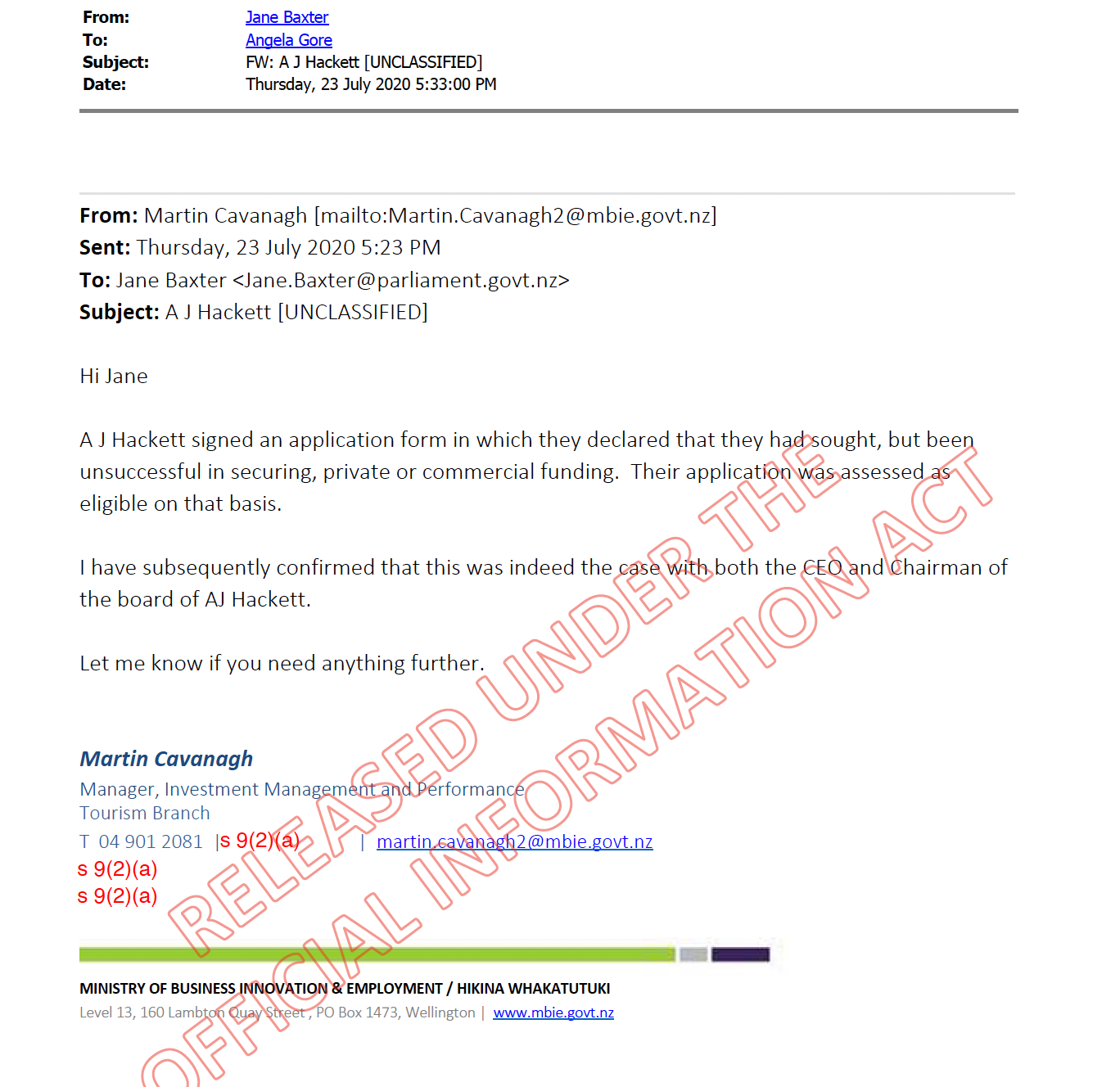

In a follow up email on July 23rd (just three days ago) from the Tourism Branch of the Ministry of Business, Innovation and Employment to the office of Tourism Minister Kelvin Davis, manager Martin Cavanagh says that he has confirmed with both the CEO and Chairman of A J Hackett that the company had been unsuccessful in securing private or commercial funding.

This email, from Thursday last week, suggests that the Government questioned A J Hackett's declaration of having exhausted all other sources of funding.

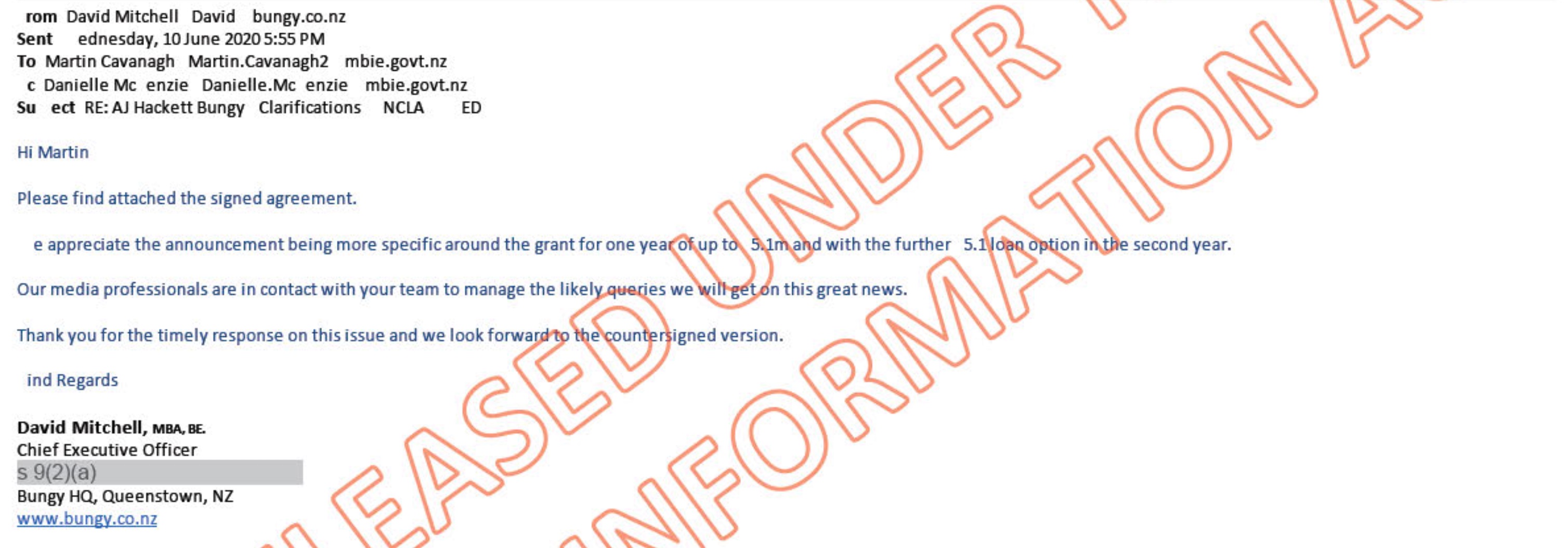

Earlier, on June the 10th, A J Hackett CEO David Mitchell appears to be synchronising with Mr Cavanagh a Government matching PR team response with A J Hackett’s “media professionals” connected with “likely queries we will get on this great news.”

Why was a team of "media professionals" necessary?

Significantly, the July 23rd email, that confirms A J Hackett had exhausted all other funding options, came a full month after Tourism Minister Kelvin Davis publicly defended the funding decision after hundreds of social media posts, and a large number of mainstream media articles, questioned the wisdom of the taxpayer funding an apparently successful and wealthy company when many smaller tourism businesses were on the brink of collapse – or had already failed.

If it transpires that A J Hackett has not been 100% accurate in submitting the taxpayer funding application, then the funding agreement has clawback provisions allowing to partial or total removal of the funding. Accounting firm Deloitte has been paid a reported $87,000 so far to analyse the funding applications under the rescue scheme.

A J Hackett declares conflicts of interest in their application form, saying such conflicts are unavoidable in a small country like NZ and a small town like Queenstown.

Conflicts of interest? Yes.

A J Hackett shareholders include former Queenstown Mayor Sir John Davies (who also owns the Trojan Holdings conglomerate that runs NZ Ski and other major, profitable tourism operations), co-founder Henry Van Asch and local Queenstown businessman Andrew Brinsley. All three men have very high levels of recorded net worth.

Economist Cameron Bagrie called the Government pay out to A J Hackett “corporate welfare” for rich listers, adding “I’m not convinced that jumping off a bridge is a strategic asset. I would have thought that’s an asset you can hibernate and wait for the demand to come back. Bungy jumps are now a strategically important asset? You have to look at this through a common sense lens and think, really?”

Crux sent the following questions to A J Hackett earlier today.

- The Government application form centres on A J Hackett exhausting all other forms of funding - the only response from your CEO is that the “bank did not respond” and he speculates that the banks may be reluctant to support tourism businesses. Can we get more detail on A J Hackett’s bank interaction - did the bank refuse any credit? Were they asked - how much for - why did they refuse? One bank or many - which banks - NZ or overseas?

- An email on July 23rd (attached) confirms total failure by A J Hackett’s bank or shareholders - plus all other sources of private and commercial funding - to put any money into the company. Does the date of this email mean the Government challenged A J Hackett post decision on this point? What form did the challenge take and what was your response?

- Another email appears to indicate a collaboration between A J Hackett “media professionals” and Government PR teams to manage queries associated with this funding decision. Can you enlighten us on what that the media strategy was and why it was necessary?

- In plain English, and in detail - why did your three main shareholders and you bankers 100% refuse to support the business?

- A J Hackett claims in emails and the application to always have paid “above minimum wage” - is this true - do you stand by this comment? Crux has evidence from previous staff that this was not the case.

- What has trading been like post Covid? Queenstown and other NZ centres have been packed … is trading good enough for you to repay taxpayer funding - partially or completely?

- Any other comment to address public concerns over this funding?

- Has Deloitte been in touch with A J Hackett to check or audit your application and subsequent financial performance?

This was the total response from A J Hackett via their PR agency.

"AJ Hackett Bungy New Zealand CEO David Mitchell says the Government’s $5.1m Strategic Tourism Asset Protection Programme grant reflects Bungy’s position as an iconic part of New Zealand’s tourism offering.

“The grant assists us to keep our Bungy, Swing, Zipride, Bridge Climb, SkyWalk, SkyJump, Catapult and other world class experiences across Auckland, Taupo and Queenstown open, instead of going into hibernation. It helps retain our capability and keeps many people in jobs, contributing to economic activity and well-being in the communities we have safely operated in for more than 30 years.”

“The company is complying with the conditions and MBIE checks required under the Government’s initiative. To date we’ve retained more than 80 jobs nationwide and we’re working hard to generate more roles as we continue to offer our life-changing gravity related experiences to New Zealanders.”

Any additional questions around the Government’s Strategic Tourism Asset Protection Programme should be referred to MBIE."

Responding to our story the New Zealand Taxpayers Union issued the following statement:

The NZ Taxpayers' Union Islay Aitchison

"This is corporate welfare at its worst. Tourism operators in Queenstown and across New Zealand are struggling and failing due to the current travel limitations. The Government shouldn't be picking winners by handing out millions in taxpayer money to a lucky few, especially extremely successful businesses such as A J Hackett that could manage the situation on their own."

"If A J Hackett did obtain funding by strategically characterising its exchange with its bank, that's completely unacceptable. If corporate welfare must go ahead, officials should be absolutely certain that private funding is unavailable to a business before any taxpayer money is provided, especially when $10,000,000 is at stake." Source: NZ Taxpayers' Union research officer Islay Aitchison.