QLDC lifts Lakeview veil - a little - following Boult disclosures

Analysis.

A week ago, Mayor Jim Boult gave an interview to the “Voice of Queenstown” - the Allied Press/ODT owned Mountain Scene – painting a rosy picture of potential $50 million to $100 million Lakeview project profits, rather than the large potential losses that Crux has been reporting.

Now senior council leaders, including CEO Mike Theelen, have stepped in to clarify many of the points made by Mayor Boult, including detail of a $5 million understatement of infrastructure costs and an unusually incomplete description of QLDC’s "confidential" profit share deal.

The interview with the Mountain Scene - but were Lakeview costs actually explained or did this turn into an own goal for Mayor Boult?

It’s still not clear why the mayor, who has a declared conflict of interest on Lakeview, decided to give a media interview at all, let alone one that appeared to reveal confidential information and contained some factual errors. QLDC’s comms team told Crux last week, after we asked why the mayor was volunteering information that Crux could not get through council media channels:

“Mayor Boult is free to speak to the media and respond to their specific queries – in the same way as any elected member – independent of any separate queries posed to Council’s executive team.” QLDC Communications Team.

In a Zoom interview with Crux this morning it was revealed that Mayor Boult’s claim of ratepayers getting “50% of the upside of whatever the developer makes” was not technically correct.

Documents now disclosed to Crux by QLDC reveal advice received from external advisors. In the case of the profit share, QLDC only gets 50% above what is referred to as the “hurdle return payable to the developer.” This is basically what the developer says they need to make as a profit margin for the entire project to be worth their while or be viable. Any ratepayer share is above that mark as noted by property consultants CBRE who were paid $400,000 by QLDC for their advice on the Lakeview deal.

Source: CBRE. Detail of a heavily redacted letter from QLDC consultants CBRE indicating the profit share terms. The hurdle is the profit the developer can make before sharing anything with QLDC.

The good news revealed to Crux today by QLDC’s Lakeview project manager, Paul Speedy, is that the council will have direct access to the developer’s accounts making it harder for any profits or surpluses to be excluded from, or understated in, the profit calculation.

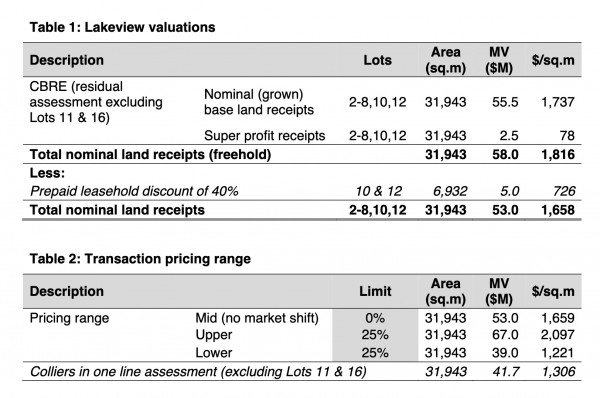

However, the same 2019 CBRE summary document says by way of introduction that QLDC should expect to make no less than $40 million out of the whole Lakeview transaction. Mayor Jim Boult told the Mountain Scene that QLDC is currently “only $4 million ahead” and was relying on the profit share agreement to get into a stronger financial position.

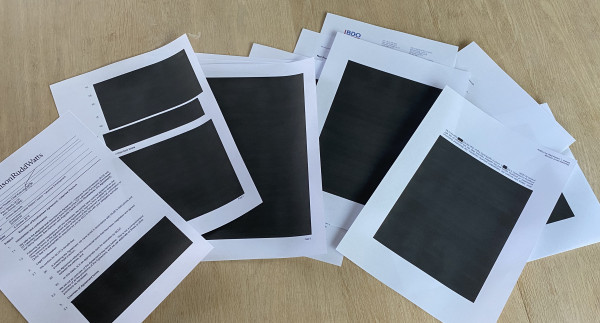

Almost 90% of the "professional advice" documents supplied to Crux by QLDC have been redacted and blacked out.

This situation has arisen because the QLDC’s infrastructure costs, originally budgeted at $19 million, have now ballooned to an eye watering $55 million – and might go even higher. The infrastructure spend is mainly through Downers, the company that Mayor Jim Boult has declared a conflict of interest in as he sits on their advisory board.

Mayor Boult. It's not clear why he would talk to media about a confidential property development agreement in which he has a conflict of interest.

In addition, Mayor Boult told the Mountain Scene that the infrastructure costs were $50 million – not the $55 million confirmed to Crux today by senior council managers including CEO Mike Theelen. So his “just $4 million ahead” is actually $1 million behind.

However, in a late twist to the story, QLDC’s comms team contacted Crux just as we were about to publish this story:

“Just one point we’d like to clarify. The total Lakeview capital works costs (site clearance and sub-division projects) are $55 million, of which $50 million is a cost of sale (funded from land sales) and $5 million is funded by rates/dc’s.(development contributions)

"Mayor Boult referenced $50 million in the Mountain Scene article which was just the amount funded by land sales.”

Detail from an early document tabled at a "public excluded" QLDC meeting suggests that the profit share or "super profit", above the "hurdle", might be as low as $2.5 million.

This point raised by the QLDC comms team means that $55 million still has to be deducted from the $77 million land sale, but the ratepayers and other building projects will have to pick up $5 million of that extra cost.

It now seems clear that any hope of a realistic council profit depends on whether the Australian developers, Ninety Four Feet make any money above their agreed “hurdle” or pre-agreed profit margin that the council gets no share of. The council document above suggests that the profit share might only amount to $2.5 million.

Community and non-financial value.

Both the Mayor and council managers have been on the same page in terms of Lakeview “not being all about money.”

The Queenstown Lakes Community Housing Trust does get land out of the deal for affordable housing and there is a set number of apartments that will be for lower paid workers using a community housing model of studio apartments linked to large, shared kitchen and lounge areas.

But the documents released to Crux mainly date back to pre-Covid times before the Downers cost blowout on Lakeview infrastructure – $36 million over budget including $12 million for unexpected asbestos removal.

Councillor Niki Gladding - says the Lakeview height increase was linked to publicly notified consent.

Apart from that, there is another key element to be taken into account, and that’s the relationship between QLDC and the developers Ninety Four Feet. Clearly the two sides were all lawyered up prior to getting the Development Agreement signed, but after the signing things started to change.

The first big change was that the developers told the council this year that they wanted the Lakeview buildings to be twice as high as originally planned. It seems unusual that they would have made that decision so late in the game and may be linked to them telling the market (BusinessDesk July 9, 2021) that Lakeview would be worth $2 billion when finished, up from $1 billion just a year or so earlier.

The critical question now is if, and how, that “hurdle” at the centre of the profit share agreement is adjusted to allow for the new increased height – and profit. There’s also the point that Crux has made in terms of the $77 million land sale payments being over a 20 year period, reducing the actual value of the deal to as little as $7 million - $14 million in current value due to inflation and opportunity cost, depending on the actual timing of the stage payments coming in.

Then, in apparent contravention of a verbal agreement reached in a workshop meeting with QLDC staff and councillors, the developers opted to go for Government fast track, non-notified resource consent. Councillor Niki Gladding has told Crux that councillors only agreed to the height increase on the condition that resource consent was publicly notified.

The new Lakeview tower blocks are double the height of the plans originally submitted to QLDC

In the Zoom call today with Crux we asked QLDC’s CEO if it was true that the developers had agreed to public resource consent notification in return for the height increase.

QLDC CEO Mike Theelen - has confirmed to Crux that the Lakeview developers did agree to publicly notified consent, but then "followed a different pathway."

“So the height was increased and they did indicate that they were going to go for, and were prepared for, full public notification. However, the law has provided them a different pathway (post Covid fast track, non-public consent) and they've elected to go with that.

“The council has commented to the Minister of the Environment through the fast-track legislation process on that. We would still prefer them to go through a publicly notified consenting process.”

It seems clear that the developer’s decision to go against the QLDC’s wishes on resource consent is significant. It might be an important rift signalling trouble ahead or just a hard-headed business decision that accepts the council’s dissatisfaction as collateral damage that can be repaired.

One thing that is clear is that Lakeview has more secrets to reveal. The irony is that Mayor Jim Boult inadvertently put pressure on QLDC managers to reveal more details of the confidential agreement by taking his (incomplete) story to the Mountain Scene.

Perhaps his actual goal was in the opposite direction.