Is QLDC’s debt worse than Auckland's?

Analysis.

Most of us have a reasonable handle on household debt. If we don’t – we run out of money.

But understanding council debt is a bit trickier – mainly because they can borrow more than us, because they own more stuff. Like airports and lots of land.

Councils can run out of money though by hitting their credit limits – just like all of us – and if that happens to a council central government has to step in and shake things up. It can get messy.

However, we’ve had a go at deciphering how much the Queenstown Lakes District Council owes, what it all means, and, if there’s a problem, what are some of the solutions?

We’ve also been lucky enough to speak with local economist Benje Patterson, who has some useful light to shed on how things work between central government cash and local government cash.

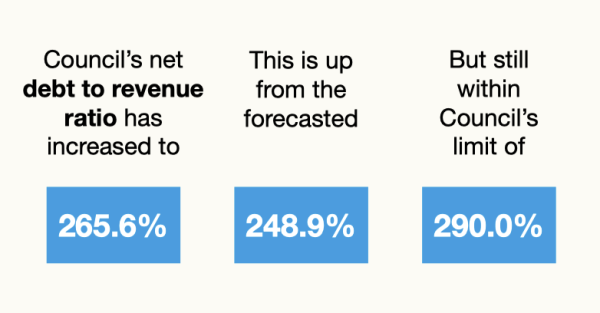

Council debt is measured, just like us, as the difference between income/revenue and liabilities/debt. There’s a limit on how much the QLDC is allowed to borrow, and that is defined as total debt being limited to 290 percent of net revenue - Or almost three times income in home mortgage terms.

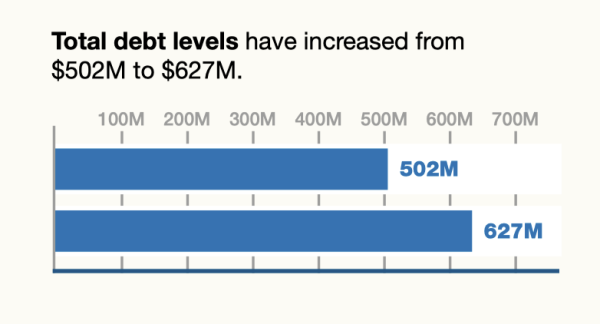

But, there’s been a huge increase in debt over the past year, from $502 million to $627 million.

QLDC's debt increase over the past 12 months (Image QLDC).

The QLDC’s income has gone up a bit as well: from $201 million to $236 million.

So how does that affect the all-important debt ratio?

QLDC's debt is getting closer to the 290 percent limit (Image: QLDC).

As you can see, that’s gone up from 248 percent to 266 percent. The QLDC says that’s “well within the limit of 290 percent”.

But, you don’t have to be an ace mathematician to figure out that difference between actual debt and the debt limit is not that great. It’s debatable what is “well within” the limit or, actually, close to the limit.

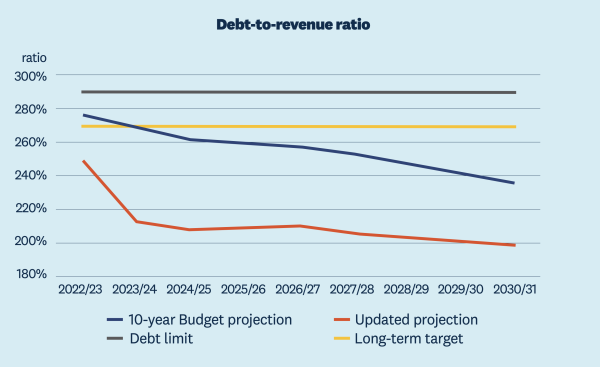

You will be aware of the dramas in Auckland as mayor Wayne Brown creates merry hell in an attempt to cut council spending, even by selling all of Auckland Council’s airport shares and sacking hundreds of council staff. But currently Auckland council debt sits at 250 percent of their 290 percent limit. That’s lower than QLDC’s debt ratio.

Auckland Council's debt ratios - heading down, in the opposite direction to QLDC's debt. (Image: Auckland Council 2023 ratepayer consultation document).

That level of debt is seen so seriously in Auckland that drastic measures like selling all of their Auckland Airport shares is being proposed to bring the debt ratio down to below 220 percent. And that should keep rate rises down around five percent in Auckland compared to a proposed 13 percent rate rise in Queenstown Lakes.

All of this might suggest the QLDC is getting itself into something of a money pit with rising debt depending on rising residential rates income at the same time as high-risk projects like Lakeview and the arterial road project have a combined budget blowout of more than $100 million. Auckland Council’s entire budget gap is $295 million by comparison across multiple agencies including Auckland Transport, Watercare, Ports of Auckland and the City Rail Link.

It’s interesting to compare the depth of budget cuts between Auckland and Queenstown Lakes.

Auckland Council’s consultation document declares a plan to cut $125 million in order to reduce debt and keep rates under control.

Auckland Council is making cuts - not deferring costs as is the case for QLDC.

The QLDC is deciding to defer rather than cut costs, and the total for QLDC's capital expenditure deferrals comes to $106.7 million.

Putting all of that together seems to suggest the QLDC is in a similar, or worse, situation than Auckland Council. And yet – there’s no dramatic public discussion here about council staff redundancies, cuts to services, the sale of airport shares or the permanent slashing of entire departments and projects.

Speaking to Crux today, local economist Benje Patterson reckons local councils in New Zealand have to carry too much infrastructure costs – including the QLDC.

Local economist Benje Patterson - creating local taxes is not the answer.

“Councils have got very limited mechanisms to generate revenue relative to central government. They’ve also got a lot of services that they're providing to people every day. And alongside that, there's also a lot of infrastructure that is at varying states of its useful life.

“But the challenge is infrastructure is so expensive. And to fund it they either need to free up cash somehow if they're lucky enough to have major assets that they can sell or be able to attract funding from other major partners, which 99 percent of the time is central government coming in and sharing some of the tax revenue that they're able to get from a multitude of different sources.”

So if the QLDC is not going to sell Queenstown Airport shares, which would be very controversial, how is our council going to find extra revenue to dig itself out of the current debt situation?

Mr Patterson reckons the answer is not local taxes or levies that he says can just cause more complication and even encourage more spending.

“I'm not a big fan of just creating more ways that local government can generate their own revenue autonomously. I think it's nice and simple as it stands at present, but there is clearly a lack of revenue. So some mechanism for government passing back money to local authorities to enable them to sustainably deliver local services and invest in local infrastructure that's above and beyond national level infrastructure would be preferred.”

Crux will be monitoring and reporting on the QLDC debt situation as it develops. You can read the full draft of the QLDC 2023/2024 Annual Plan and debt/budget proposals here.