Airport risks bank limits over redundant $200 million land purchase

This article has been found to breach Media Council Principles of Accuracy, Fairness, Comment and Fact, and Headlines and captions. The full Media Council ruling is at www.mediacouncil.org.nz

After fighting for 10 years to buy a piece of land near Queenstown Airport, the QAC now needs to find up to $263 million to finance the purchase, even though the land is no longer needed.

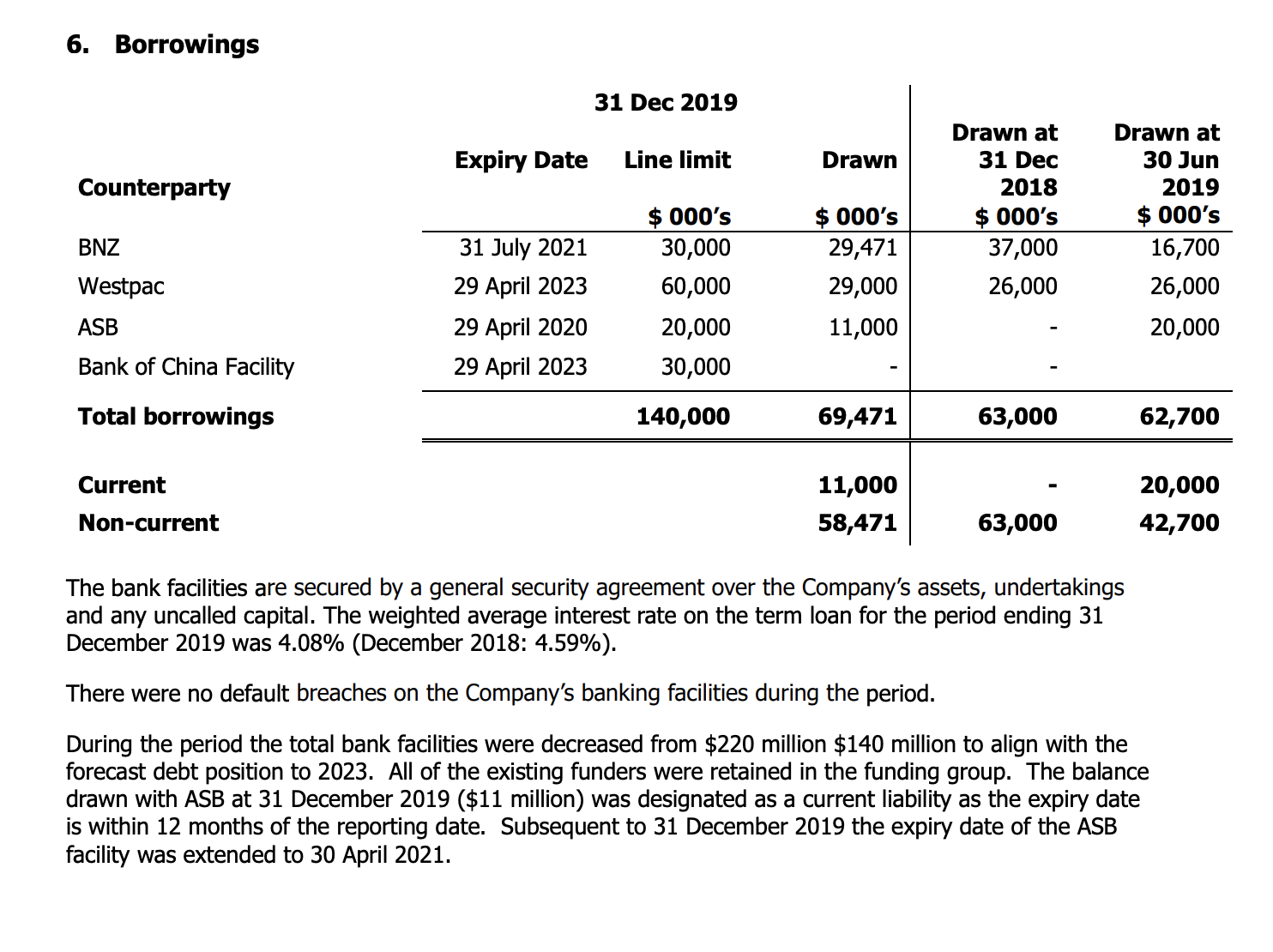

Such a purchase will exceed the airport’s current $140 million borrowing limits and put it in breach of current bank lending facilities.

There is now a real risk the airport will have to sell shares to finance the land purchase, a move that could see the airport disappear from majority QLDC ratepayer ownership. Even the sale of shares could be difficult or non-viable post Covid-19.

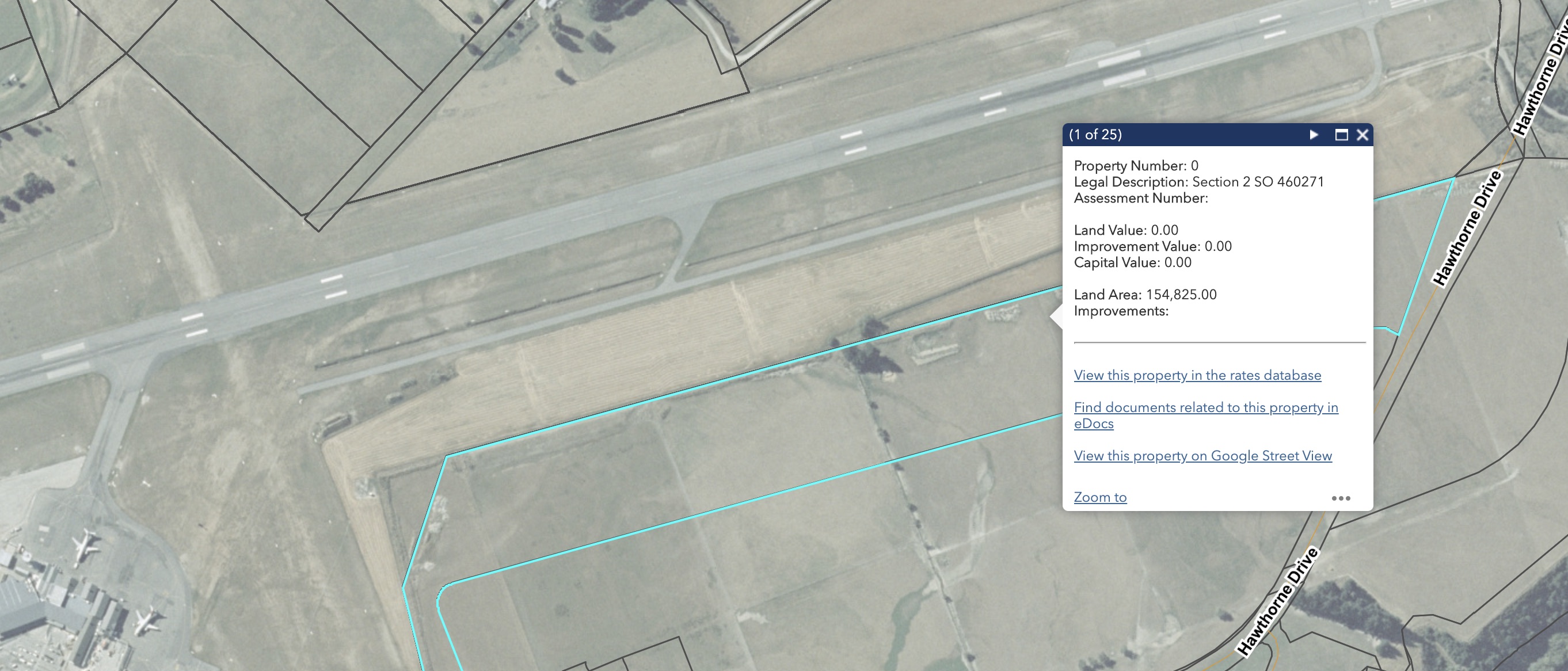

Lot 6 - not needed for expansion - but the purchase cannot be stopped.

Crux understands the land acquisition process for Lot 6, on the southern side of the main runway, cannot be reversed. The purchase was through the Public Works Act and was signed and sealed late last year after a bitter and expensive legal battle.

The plan was to use the Lot 6 land to shift the existing terminal building and improve airport ground facilities. The new terminal was linked to forecast passenger numbers of over 5 million each year.

Now, post Covid-19, any chance of those facilities being needed in the next five or ten years seems more than remote. In addition, a recent QLDC study has found that the community is opposed to virtually all flavours of Queenstown airport expansion.

In fact, community sentiment was clear in late summer 2018 when respondents to both an official Queenstown Airport survey and a Crux survey voted overwhelmingly against any airport expansion. At that stage Crux understands the QAC could have withdrawn from the purchase of Lot 6, but did not.

Land owner Alastair Porter - a skilled and determined negotiator

Ironically, the land in question was once owned by Queenstown Airport but they disposed of it to the same landowner who they now have to buy it back from – Alastair Porter.

Sources close to Mr Porter indicate that his expectations, linked to other recent sales within his Remarkables Park development, are in the $750 to $1,700 per square metre range. That means that QAC will have to find up to $263 million to buy the land.

At the low end of the valuation scale Lot 6 will still cost $116 million. Even that lower number would breach current bank lending limits – that include lending from the Bank of China. The QAC currently has over $70 million of debt and around $1 million in cash, according to the latest published accounts - pre Covid-19.

Lot 6 comprises 154,825 square metres and Crux understands that the value will have to be locked in at pre-Covid prices because that’s when the deal was finalised under the Public Works Act. QAC currently has access to the land but the sale price is still being negotiated with Mr Porter. He is understood to be “patient” with the process, but is well known as a determined and long-term negotiator. He is unlikely to let QAC off the hook in any way given the bruising court battles that have preceded the land sale.

QAC's current debt - not a lot of head room to finance Lot 6 purchase

Crux approached the Queenstown Airport Corporation for comment on Monday this week, asking a number of detailed questions about Lot 6, how the purchase was to be funded and if the airport would try to on-sell the land in order to reduce debt.

None of these questions were answered with the airport’s senior comms person, Sara Irvine, simply referring Crux to the latest Statement of Intent that records the finalising of the land deal last year.

Acting QAC Chair Adrienne Young-Cooper - not responding to questions about Lot 6

Crux then tried to contact the acting Chair of the Queenstown Airport Corporation, Adrienne Young-Cooper, to obtain her perspective on the Lot 6 situation.

Ms Young-Cooper lives in Wellington according to public records but is currently Chair of Auckland Transport. In fact all of the Directors of the Queenstown Airport Corporation are Auckland based apart from Simon Flood, a retired investment banker, with links to Mayor Jim Boult, now living in Queenstown after a career in Asia.

Ms Young-Cooper did not respond to messages but Crux was contacted earlier today by QAC comms’ Sara Irvine to say we could write to Ms Young-Cooper at the airport’s postal address or send an email to a supplied QAC administration email address.

The latest accounts from the Queenstown Airport Corporation value the airport’s total assets (including Wanaka) at $365 million.

Councillor Niki Gladding signalled her concerns about QAC's strategies in a piece written for Crux on April 9th.

In this article she raised questions as to why the QAC's Statement of Intent was fast tracked through a council approval process in these very uncertain Covid-19 circumstances.