Government funds new Queenstown affordable housing

From the Queenstown Lakes Community Housing Trust:

The Queenstown Lakes Community Housing Trust (QLCHT) has received confirmation of a $6.35m interest-free loan from the Government.

Housing Minister, The Hon. Megan Woods, today announced the government would commit $6.35m to supporting QLCHT’s assisted home ownership programme, Secure Home. Today’s announcement is part of the first phase of a wider Progressive Home Ownership scheme the government is rolling out across the country.

How the Toru apartments will look at Remarkables Park

The loan will provide funding for 25 Secure Home properties within the Toru development at Remarkables Park, Frankton. The Trust has a contract to purchase 50 Toru apartments which are due for completion early 2021.

QLCHT Chair Andrew Blair

QLCHT Chair, Andrew Blair says: “We are delighted to receive Government backing of this scale – it demonstrates clear support for our innovative Secure Home programme which we launched last year.”

“We have had a contract on the Toru apartments for two years, but following the COVID-19 crisis, we are very grateful for this Government assistance, which will ensure we are able to offer these properties to the 600 households on our waiting list.” Blair says.

Executive Officer, Julie Scott, notes she has been part of a collective working with the Government to design the $400m Progressive Home Ownership scheme, which aims to help several thousand low-moderate income renter households into their own homes.

Queenstown Lakes Community Housing Trust CEO Julie Scott

She notes “It’s great to see Government recognition for alternative home ownership programmes like those our sector offers. Financial support of this nature will enable community housing providers across New Zealand to scale up and help more Kiwis into home ownership.”

The first of its kind in New Zealand, Secure Home is a programme where buyers purchase the properties through a 100-year lease arrangement, with the Trust retaining ownership of the land in perpetuity.

Here is the Government's full announcement:

More New Zealanders will be helped into home ownership with today’s launch of the Government’s Progressive Home Ownership scheme, Housing Minister Megan Woods said.

“Under-investment in housing and infrastructure in the past has made the aspiration of home ownership impossible for too many families,” Megan Woods said.

“I’m delighted the Government is once again delivering solutions to enable more families to own their own homes and secure their futures.”

The first phase of the $400 million fund has signed up providers in Auckland and Queenstown to support the first 100 low to median income families who are struggling to pull together a deposit, or pay a mortgage, into home ownership.

Megan Woods named the Housing Foundation in Auckland and Queenstown Lakes Community Housing Trust as the first providers who will sign up households for access to the scheme. More phase one providers in other centres will be announced soon.

“The fund will focus on areas where housing affordability is most severe, with a strong preference for new houses to build supply,” Megan Woods said.

“It will help up to 4,000 families who could not otherwise afford home ownership. We expect to see the first group of families in their own homes by November this year.”

The fund has a priority to support:

- locations with severe housing affordability,

- households unable to otherwise buy, and

- Māori, Pacific people, and families with children.

The fund will scale up funding for organisations already providing PHO schemes with wraparound support services, such as budgeting advice. As part of this approach, there will be a dedicated iwi and Māori pathway, with a specific focus on better housing outcomes for Māori.

The fund also includes an initiative through Kāinga Ora for households with an annual income of under $130,000 to receive shared ownership support directly from the Government.

The Progressive Home Ownership fund is part of the Green Party and Labour’s Confidence and Supply Agreement.

“We know that high rents make saving for a deposit almost impossible for many families,” Green Party Co-leader and housing spokesperson Marama Davidson said.

“This fund means more low income families who have been locked out of the housing market will finally have a chance at owning their own home. We’re proud to be part of a Government working to ensure everyone has the home they deserve,” Marama Davidson said.

There is more information here.

Questions & Answers

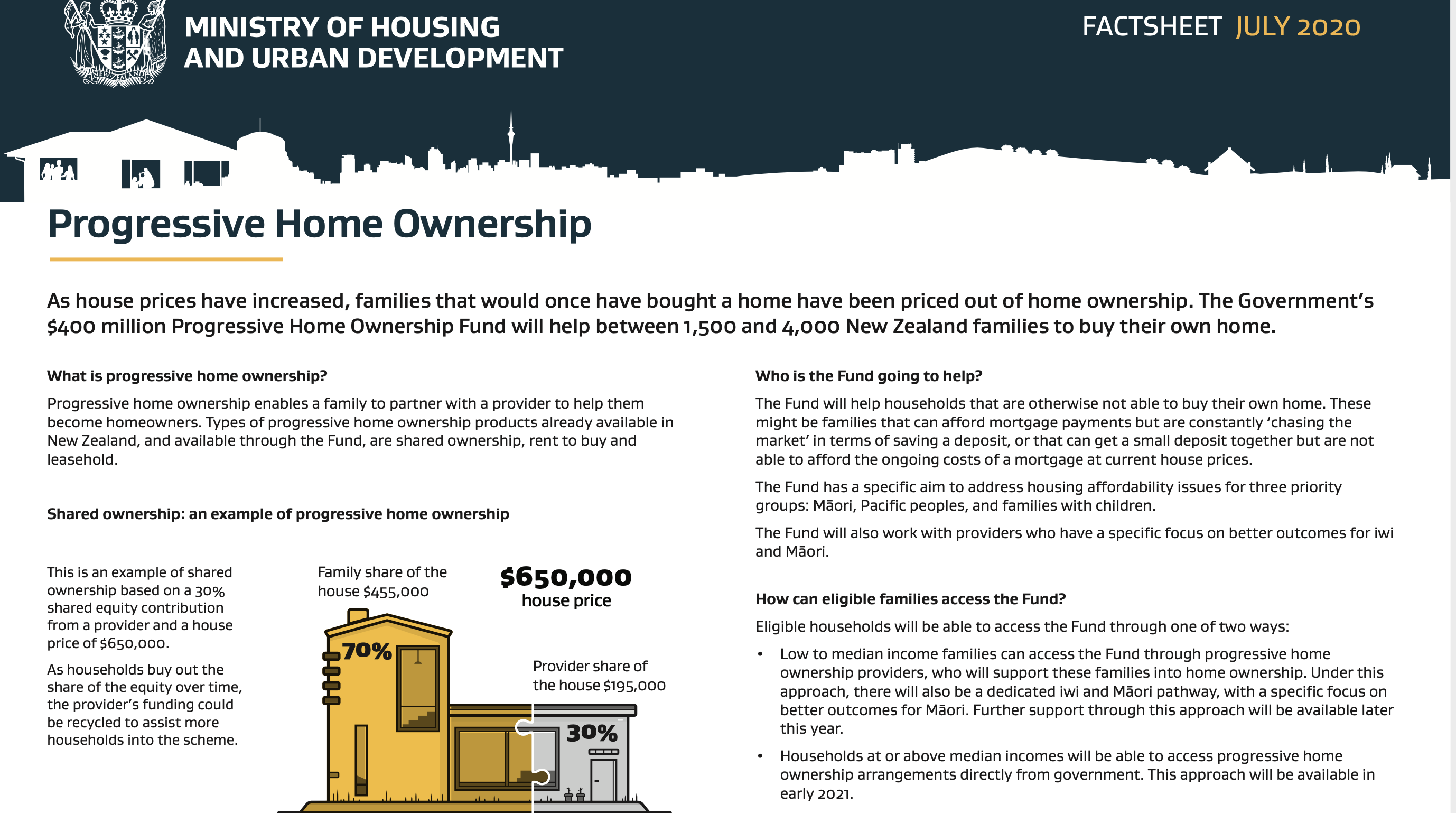

What is progressive home ownership?

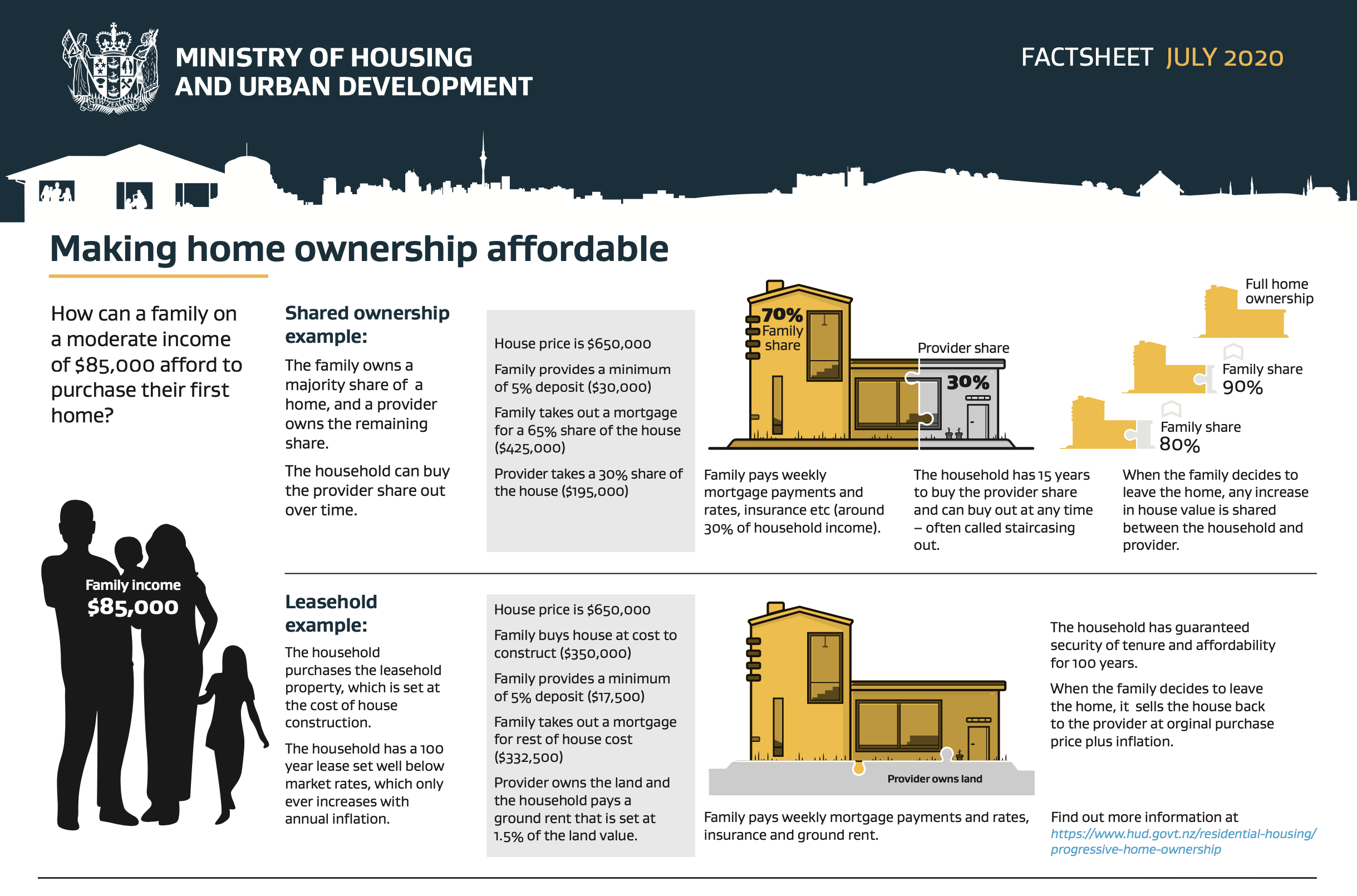

Progressive home ownership enables a family to partner with a provider to help them become homeowners. It can take several forms, including:

- Shared equity or ownership, where a household owns part of the home and a third party owns the rest. Over time the household buys back the portion of the home from the third party (e.g. housing provider or the Crown).

- Rent to Buy, where the provider purchases a house outright and a household rents that home from the provider, possibly at below market rates to enable them to save a deposit. Alternatively, a standard market rent could be charged with the provider setting aside a portion of that rent as a deposit on behalf of the homeowner. The household may have the right to purchase the home either outright or through a shared equity scheme.

- Leasehold, where a provider sells a home to a household but retains ownership of the land beneath it. The exclusion of land from the purchase lowers the deposit and servicing cost for the homeowner. The homeowner may be required to pay a ground rent to the landowner for ongoing use of the land. In some cases, homeowners may have the right to purchase the land from the provider at a later date, once the homeowners have paid down some of their debt and are better able to afford it.

Why is the Government funding the Progressive Home Ownership Fund?

As house prices have increased, many families who could once have purchased a home have been priced out of home ownership. Families who can service some but not all of a mortgage are more likely to be families with children, and Māori and Pacific peoples. Given the gap between house prices and what is affordable to these families, many will not be in a position to purchase a home in the future. Progressive homeownership schemes can help these families by sharing the cost of a mortgage and addressing the deposit barrier.

These innovative arrangements are already offered in small numbers through community housing providers. Building a role for Government in their delivery, and supporting those that provide them to scale up and expand the number of people they can help, is a way to increase the number of New Zealanders able to own their own homes and to build the country’s housing stock.

Who is the Progressive Home Ownership Fund going to help?

The Progressive Home Ownership Fund aims to help:

- lower to median income families who are unlikely to buy a home without a reasonable level of financial and non-financial support, and

- at or above median income families who cannot get a large enough deposit together to buy a home due to high rents and fast-growing house prices, and/or have insufficient income to service a low deposit mortgage at current house prices.

Who is eligible for funding?

The criteria for funding includes:

- applicants must be over the age of 18,

- applicants must not currently own any property in New Zealand or overseas,

- applicants must be a New Zealand Citizen, Permanent Resident, or Resident Visa Holder who is 'ordinarily resident in New Zealand',

- applicants must have a household income of under $130,000 per year

- applicants need to be first home buyers or ‘second chancers’ (as defined in the eligibility criteria for KiwiBuild), and

- applicants will need to be able to secure a commercial mortgage (i.e. good credit histories, minimal debt), and have saved some amount of deposit.

How many people will the Fund help?

We expect between 1,500 and 4,000 households will be helped into home ownership through the Fund. The number will depend on the amount of money loaned to each recipient and how quickly they are able to pay it back.

Will the Fund help more Māori into home ownership?

The Progressive Home Ownership Fund has a specific aim to address affordability issues for Māori, Pacific peoples, and families with children.

Officials are working with iwi and Māori providers and organisations to ensure that the Fund can deliver better home ownership outcomes. This includes looking at:

- how progressive home ownership schemes can be accessible to Māori (including in rural areas and on Māori land), and

- how Māori providers (existing or emerging) are able to scale up.

Why is the government prioritising Auckland and Queenstown?

The first two confirmed providers are for housing projects in Auckland and Queenstown, both areas with significant housing affordability issues. Further Phase One housing providers and projects will be announced in the coming weeks and reach other areas of the country.

How much is this going to cost?

The Government has made $400 million available for the delivery of Progressive Home Ownership schemes. Funding is also available for providers to provide households with non-financial support, such as financial capability services.

Will the government get the $400 million in funding back?

Yes, funding needs to be returned to the Crown.

When will housing providers be able to apply through the Fund?

Phase One of the Fund has started with community housing providers already experienced in delivering progressive homeownership schemes. We expect funding will be available to a wider panel of providers later this year.

While Phase One is significant, with a sizeable amount of funding available through repayable loans, the full fund will have a much bigger scale. A provider that is not involved in Phase One may (if eligible) still be engaged for the full fund. HUD will share lessons from phase one with all providers so there is no first mover advantage.

When will the direct government scheme be available?

The Ministry of Housing and Urban Development is still designing the Progressive Home Ownership scheme that will be available direct to households. We expect that it will be available in early 2021 and will be led by Kāinga Ora.

Is the progressive home ownership scheme the KiwiBuy Coalition scheme?

No. While the KiwiBuy proposal and the Progressive Home Ownership Fund share an objective of scaling up provision of Progressive Home Ownership schemes by existing providers, the Fund will also provide new pathways to access such schemes and support a wider range of households into homes than the KiwiBuy proposal.

What information has been used to model the funding?

We have modelled the financial outcomes for the scheme on a number of assumptions such as interest rates, regional prices, capital value increase, target group characteristics/incomes, and exit paths. We have also undertaken initial actuarial modelling and sensitivity testing. These will be refined as more data becomes available through phase one.

How does the PHO Fund fit in with other homeownership opportunities developed by the Government?

The Fund sits alongside our other key housing programmes to help ensure every New Zealander has a safe, warm, dry home to call their own. It will be an important tool to assist some people into home ownership who otherwise would not be able to buy a home. The Fund is part of the government’s comprehensive housing programme, which includes working to:

- prevent and reduce homelessness and reduce reliance on motels as emergency accommodation. Funding provided through Budget 2019 will expand and strengthen the Housing First programme and help to fund and maintain over 2,800 transitional housing places throughout New Zealand

- make life better for renters, by passing the Healthy Homes Guarantee Act 2017. We have also banned letting fees, and our reforms of the Residential Tenancies Act are underway

- increase the stock of public houses owned by Kāinga Ora and community housing providers. Through Budget 2018, we funded the delivery of 6,400 new public housing places, of which 2,178 were delivered in 2018/19.

The Government has also improved incomes for low- and middle-income families with children through the Families Package in 2018. The Families Package increased the Accommodation Supplement, providing around135,000 households with an extra $35 per week on average to help pay for their housing related costs.